In presenting Fibonacci Trading tools, candlesticks, and chart price patterns, we concentrate on the ones that have a high analytical value and can be combined with each other. Our goal is to avoid information overf low, while providing adequate detail, because all of the strategies can be important in different market situations.

A key question is whether all of these patterns have a common denominator. The answer is a definitive “yes”—all of them include the

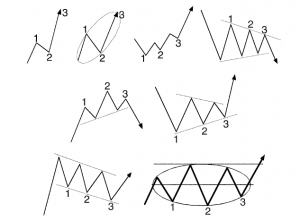

figure three:

• Three waves in price extensions.

• Three waves as the basic structure of the PHI-ellipse.

• Three peaks and valleys in triple top/bottom chart patterns.

• Three peaks and valleys in head and shoulder formations.

• Three peaks (or valleys) in symmetrical, ascending, or descending triangles.

• Three rising valleys and three falling peaks formations.

• Three peaks or valleys in rectangles, f lags, wimples, wedges, and other chart formations.

Traders who analyze only chart patterns that feature the figure three and eliminate all other formations may lose some price moves,

but their overall analysis will be safer and more accurate because they will know what to look for on the price charts. The biggest advantage of this approach is that most investors can identify patterns and execute corresponding trading strategies with or without a computer.

Figure below shows eight relevant chart patterns based on the figure three.

The PHI-ellipse is the best trading instrument for daily and intraday trading. What makes this trading tool interesting and unique is its ability to surround most chart patterns that include the figure three. Whenever we can integrate chart patterns into the PHI-ellipse, it allows us to work with only one trading tool. This is why in this book we focus on trading tools that have similar characteristics, and many times we identify the same turning points or breakouts, but from a different perspective.

Candlesticks, Fibonacci, and Chart Pattern Trading Tools: A Synergetic Strategy to Enhance Profits and Reduce Risk

Robert Fischer & Jens Fischer